A Kind of property and description b Date aquired. Financial statements are the reports or statements that provide the detail of the entitys financial information including assets liabilities equities incomes and expenses shareholders contribution cash flow and other related information during the period of time.

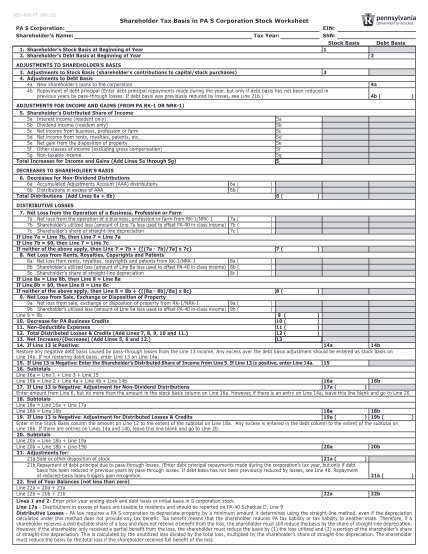

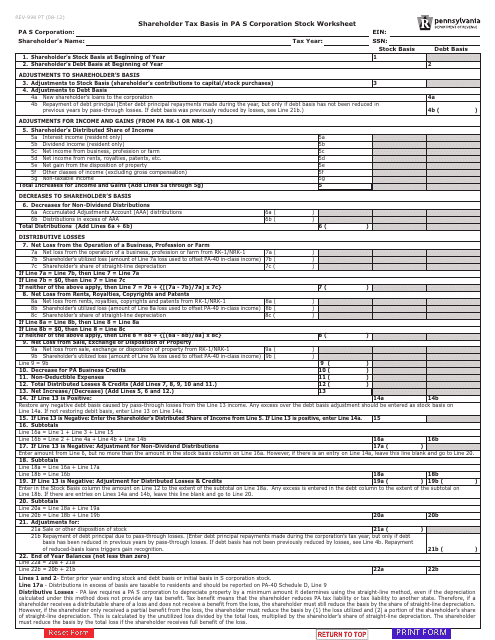

REV-413REV-414 PS -- 2020 PA Nonresident Withholding Tax Worksheet for Partnerships PA S Corporations Estates and Trusts Form and Instructions REV-998 -- Shareholder Tax Basis in PA S Corporation Stock Worksheet.

. Inventory back into cash or 12 months whichever is shorter b. Any debt loaned from third parties to the corporation does not increase the debt basis of the shareholder. The allocation to four quarter will be done on cumulative basis eg salaries 1st quarter sh 6000 2nd quarter sh 12000 etc.

Income is Deduction Percentage is 25000 or less 35 From 25001 to 50000 25 From 50001 to 100000 15 From 100001 to 125000 5 125001 or more 0. 252 1961 affd 297 F2d 837 3d Cir. Full PDF Package Download Full PDF Package.

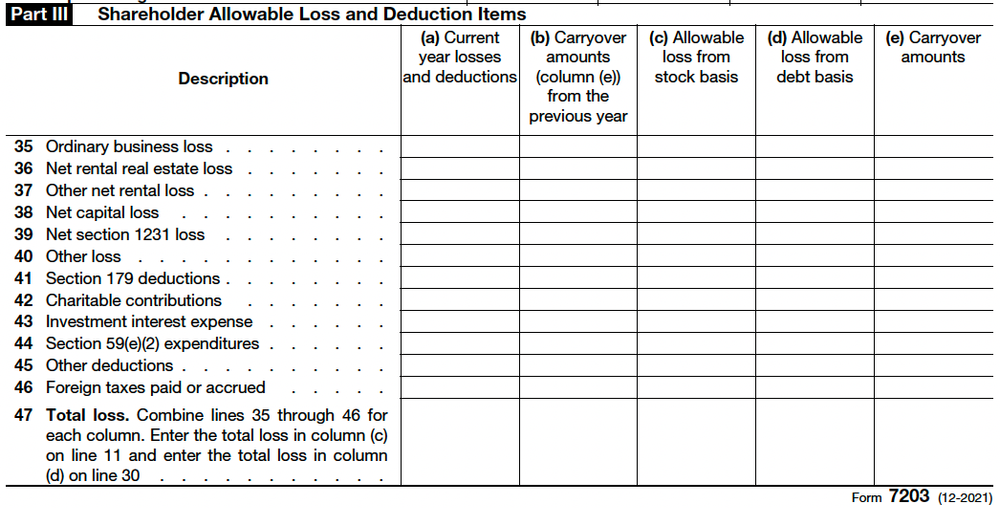

Letter Ruling 8920019 is based on Sec. Your Schedule K-1 items automatically allocate and update as business income deductions and credits change. The IRS published a notice in the Federal Register on July 19 2021 asking for comments on a new Form 7203 S Corporation Shareholder Stock and Debt Basis Limitations and related instructions.

Based on basis limitations at-risk limitations and passive activity limitations before being reported on a shareholders tax return. Tion of the ratio of Louisiana net income on a federal basis to federal net income in the computation of the federal income tax deduction. Surveys and market research on company.

The basis for classifying assets as current or noncurrent is a period of time normally elapsed from the time the accounting entity expends cash to the time it converts a. Learn if your business qualifies for the QBI deduction of up to 20. Depending on your income level your capital gain will be taxed federally at either 0 15 or 20.

This is shown for Val in example 13 and in the completed Capital gain or capital loss worksheet PDF 97KBThis link will download a file Example 13. The notice describes the proposed form in an abstract section as follows. The qualifying periods in 2020 end on April 11 May 9 June 6 July 4 August 1 August 29 September 26 October 24 November 21 and December 19 2020.

Also known as a promissory note this legal contract is a mutually agreed arrangement between two people and it specifies the details of the parties involved the amount that is owed the date time period rate of interest etc. Choosing the indexation or discount method Val bought a property for 150000 under a contract dated 24 June 1991. If you previously filed a Form IT-2104 and used the worksheet or charts you should complete a new 2021 Form IT-2104 and.

Research on ways to get new business. 6013 as applied in Coerver 36 TC. The list of codes and descriptions have been moved from the second page of Schedule K-1 Form 1120-S to these instructions.

The worksheet on page 4 and the charts beginning on page 5 used to compute withholding allowances or to enter an additional dollar amount on lines 3 4 or 5 have been revised. The first step in how to calculate long-term capital gains tax is generally to find the difference between what you paid for your property and how much you sold it for adjusting for commissions or fees. 1962 in which the Tax Court stated that a joint return under Sec.

Basis Worksheet to the Return. Other information A Investment income Form 4952 line 4a B Investment expenses Form 4952 line 5. A short summary of this paper.

The shareholder information must include the name the address and Social Security Number of the shareholder the number. A list of distribution channels marketing opportunities and marketing risks. A lease is a legally-binding contract used when a landlord the lessor rents out a property to a tenant the lessee.

To compute basis you need to know 1The shareholders initial cost of the stock and additional paid in capital 2The amount of any bona fide loans made directly from the shareholder to the S corporation as well as any loan repayments and. This written agreement states the terms of the rental such as how long the tenant will rent the property and how much they will pay in addition to the repercussions for breaking the agreement. This is done to identify and represent qualified candidates to work along with the client as the client pays a fee to the recruiters that are set by the parties.

3 Full PDFs related to this paper. 6013 does not create a new tax personality which would be entitled in its own right to deductions not otherwise available to the individual spouses under the pertinent sections of the statute. REV-999 -- Partner PA Outside Tax Basis in a Partnership Worksheet.

List and description of competitors including strengths weaknesses market position and basis of competition. Debt basis is computed and updated similarly to stock basis but there are few differences. Income or loss and is not reportable by the shareholder.

A recruitment agency agreement is considered to be an agreement that is made between two parties where one party which is the recruiting or a recruiting firm is hired by the other party including the client company. Shareholder is not obligated to pay tax on any portion of a hybrid corporation. Shareholders get basis in debt that they personally loan to the S corporation.

Intermediate accounting solutions manual. For those employers who have applied for the subsidy as soon as this could be done this shouldnt cause problems. Shareholder must report this as net pro rata share of S corporation income.

A payment agreement should be formulated before one decides to get involved in any form of monetary exchange be it lending money or borrowing it. Once complete Schedule K-1 data can be imported into your 1040 TaxAct return. Items affecting shareholder basis A Tax-exempt interest income Form 1040 line 8b B Other tax-exempt income See the Shareholders Instructions C Nondeductible expenses D Distributions E Repayment of loans from shareholders 17.

It is no longer possible to provide useful reporting information to taxpayers on one page. In other words it is accounted for on an accrual basis not a cash basis. Refer to the worksheet and instructions provided on Pages 27 and 28.

Names as shown on Form NJ-1040NR Your Social Security Number PART I Net Gains or Income From List the net gains or income less net loss derived from the sale exchange or other Disposition of Property disposition of property including real or personal whether tangible or intangible. Current ad programs marketing budgets and printed marketing materials. Form IT-2104 has been revised for tax year 2021.

These statements normally require an annual audit by independent auditors and are presented along with other. The portion of the income or loss allocated outside New Jersey is consid ered S corporation income. Internal Revenue Code IRC Section 1366 determines the shareholders tax liability from an S corporation.

The fixed cost budget will therefore appear as below- period 3 months 6 months 9 months 12 months shs shs shs shs Salaries 6000 12000 18000 24000 rent 450 900 2350 1800 fixed cost Fixed cost for the whole year. The Qualified Business Income QBI Deduction is a tax deduction for pass-through entities.

How Does The Stock Exchange Work Stock Market Printable Math Worksheets Worksheets

101 Shareholders Agreement Template Two Parties Page 5 Free To Edit Download Print Cocodoc

Meeting Minutes Templates 10 Project Meeting Minutes Templates Formats All Form Templates Meeting Agenda Template Meeting Agenda Agenda Template

Shareholder Basis Schedule Help S Corp Module Intuit Accountants Community

Form Rev 998 Download Fillable Pdf Or Fill Online Shareholder Tax Basis In Pa S Corporation Stock Worksheet Pennsylvania Templateroller

10 Share Certificate Templates Word Excel Pdf Templates Certificate Templates Certificate Of Recognition Template Certificate Of Participation Template

Business Ownership Transfer Letter How To Write A Business Ownership Transfer Letter Download This Business Ow Letter Templates Lettering Download Templates

Shareholder Basis Schedule Help S Corp Module Intuit Accountants Community

Rev 998 Shareholder Tax Basis In Pa S Corporation Stock Worksheet Free Download

Formal Draft Of Proposed Form 7203 To Report S Corporation Stock And Debt Basis On Form 1040 Released Current Federal Tax Developments

Formal Draft Of Proposed Form 7203 To Report S Corporation Stock And Debt Basis On Form 1040 Released Current Federal Tax Developments

Rev 998 Shareholder Tax Basis In Pa S Corporation Stock Worksheet Free Download

ConversionConversion EmoticonEmoticon